unlevered free cash flow dcf

However we also need to ensure the company has enough cash to pay down its debt obligations in an acquisition scenario. Valuing companies using the DCF is considered a core skill for investment bankers private equity.

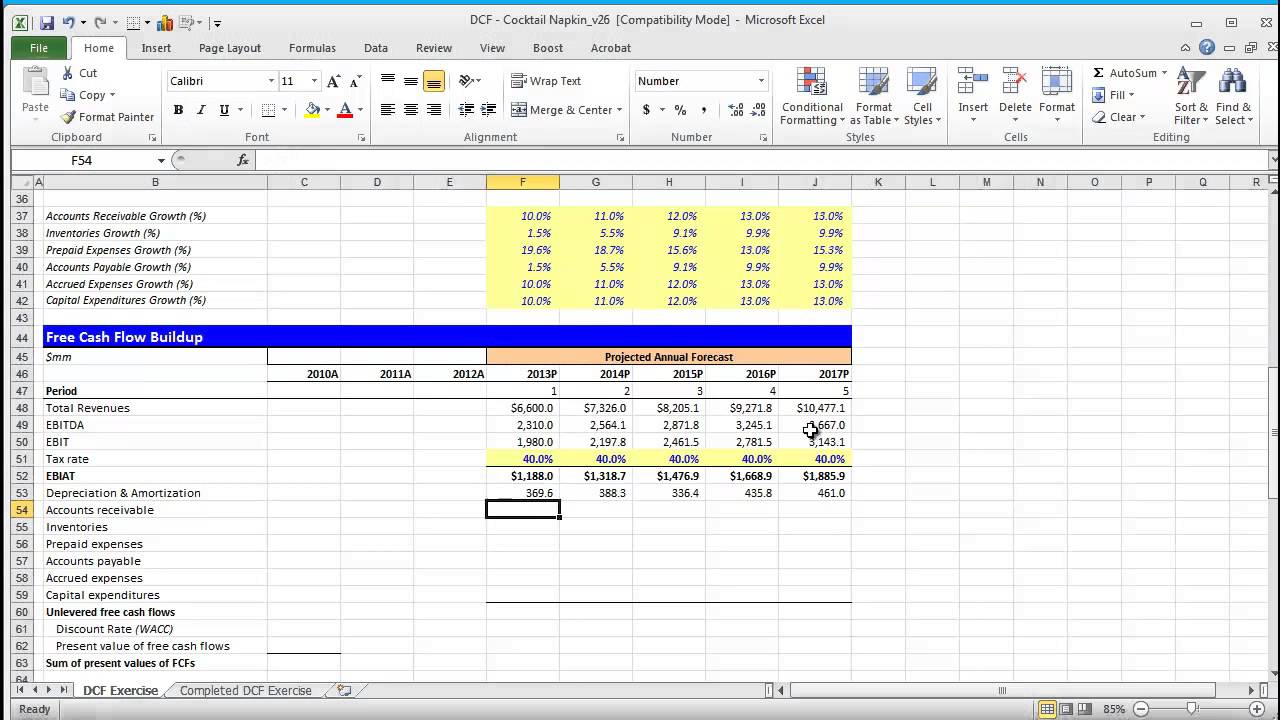

Discounted Cash Flow Dcf Valuation Model Excel Tutorials Cash Flow Excel Templates

A discounted cash flow model DCF model is a type of financial model that values a company by forecasting its cash flows and discounting the cash flows to arrive at a current present value.

. If not the intrinsic value is not worth much because the company will be defunct. To calculate the value of a company using a discounted cash flow DCF model we use unlevered free cash flow to determine its intrinsic value. The generic Free Cash Flow FCF Formula is equal to Cash from Operations Cash Flow from Operations Cash flow from operations is the section of a companys cash flow statement that represents the amount of cash a company generates or consumes from minus Capital Expenditures Capital Expenditures Capital expenditures refer to funds that are used by a.

The cash flow most commonly used to calculate the ratio is the cash flow from operations Operating Cash Flow Operating Cash Flow OCF is the amount of cash generated by the regular operating activities of a business in a specific time period although using unlevered free cash flow Unlevered Free Cash Flow Unlevered Free Cash Flow is a theoretical cash flow figure for. The formula for net cash flow can be derived by using the following steps. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

The DCF has the distinction of being both widely used in academia and in practice. Unlevered free cash flow can be reported in a companys. FCFF Free cash flow to firm also known as unlevered cash flow is the cash remaining with the company after depreciation taxes and other investment costs are paid from the revenue and it represents the amount of cash flow that is available to all the funding holders be it debt holders stock holders preferred stock holders or bond holders.

Firstly determine the cash flow generated from operating activitiesIt captures the cash flow originating from the core operations of the company including cash outflow from working capital requirements and adjusts all other non-operating expenses. Unlevered Free Cash Flow - UFCF. When to Use Free Cash Flow.

Finance And Investment Toolkit In 2021 Investing Finance Business Case Template

Finance And Investment Toolkit In 2021 Investing Finance Business Case Template

Discounted Cash Flow Analysis Example Dcf Model Template In Excel In Stock Analysis Report Template 10 Professional Stock Analysis Report Template Cash Flow

Investment Banking Technical Interview Question Bad Valuation Multiples Such As Ev Earnings Price Ebitda Accounting Basics Financial Modeling Study Program

Westfinance I Will Build Excel Financial Model Forecasts Budget Business Plan For 95 On Fiverr Com Business Planning How To Plan Budgeting

Landscape Bitcoin Business Social Business Technology Infrastructure

Discounted Cash Flow Dcf Excel Model Template Cash Flow Cash Flow Statement Financial Charts

Dell Buys Emc For 67b In Largest Deal In Tech History

Calculating Nike S Fair Value By Projecting Free Cash Flows Nike Logo Wallpapers Nike Drawing Symbol Drawing

Hotel Valuation Financial Model Template Efinancialmodels Budget Forecasting Hotel Revenue Management Financial Modeling

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial

Finance And Investment Toolkit In 2021 Investing Finance Business Case Template

Nike Futura Logo On Behance Nike Nike Design Nike Wallpaper

Finance And Investment Toolkit In 2021 Investing Finance Business Case Template

Nike Futura Logo On Behance Speed Art Illustration Typography Logo

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff In 2021 Cash Flow Statement Cash Flow Financial Analysis

Steel Industry Financial Model Enterprise Value Financial Investment Analysis

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial

Free Spreadsheet Templates Finance Excel Templates Efinancialmodels Spreadsheet Template Amortization Schedule Amortization Table